The housing market continues show contracting sales volume. April existing home sales fell 0.4% (SAAR – Seasonally Adjusted Annualized Rate) from March and 4.4% from last April. Existing home sales have dropped year-over-year 14 months in a row. This is the worst run since the housing crisis.

Obviously from a seasonal standpoint, if the market were healthy, home sales should be increasing month-to-month notwithstanding questionable statistical “adjustments” imposed on the data by the NAR. Furthermore, existing home sales are based on closings, which mean the report measures contracts that were signed in late February to late March/early April. during this period the 10yr Treasury rate fell from 2.8% to as low as 2.35%. But lower rates are not stimulating home sales in spite of rapidly rising inventory.

This is because the much of the remaining “pool” of potential home buyers can not afford the all-in cost of home ownership in spite of lower financing costs. Almost 30% of all mortgages that Fannie and Freddie underwrote and packed into bonds last year were for home buyers whose total debt payments were in excess of 43% of their gross (pre-tax) income. This metric – the borrower’s DTI – has nearly doubled since 2015. The mortgage/housing market is headed for a repeat of 2008.

New home sales also showed a drop from March. But the March number was curiously revised significantly higher – an upward revision to 723k SAAR. The number is so much higher than any number reported for any month in the last 12 months that it looks comical in the data series. John Williams (Shadowstats.com) referred to the report as “regular nonsense monthly volatility and lack of statistical significance.” In fact, the jump in new home sales tabulated by the Government does not remotely correlate with mortgage purchase application data released by the Mortgage Bankers Association, which shows a decline in purchase applications that would correspond to April’s new home sales data

NOTE: new home sales are based on contracts signed. 90% of all new homebuyers use a mortgage. Therefore declining purchase apps would translate into decline new home contract signings. New homebuilders, for the most part, have been reporting declining new home orders (see Toll Brother’s latest earnings release from last Monday, for instance).

This brings me to an exchange between Texas real estate professional, Aaron Layman, and the deputy chief economist at Freddie Mac – Lawrence Kiefer. It seems that this Freddie Mac executive could not understand by lower interest rates were not translating into higher home sales. This economics Einstein was puzzled that the large pool of millennials were renting rather than buying. It’s pretty clear that this ivory tower dork is clueless about the amount of student debt held by the millennial demographic. Kiefer suggested to Aaron that higher student debt levels could possibly be net positive for the housing market if it leads to higher incomes. The Twitter exchange between Aaron and Mr. Kiefer has left me speechless. You can read more here: Aaronlayman.com

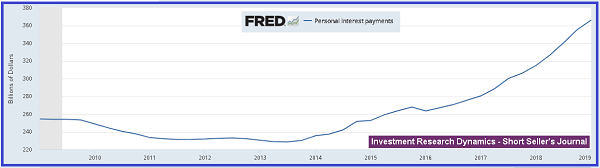

Perhaps studying this chart might help Freddie Mac’s Mr. Kiefer better understand the basic problem:

In my weekly Short Seller’s Journal, I present detailed analysis of the housing market, pulling back the curtain of lies used by industry pimps to hide the truth. In addition, I provide specific short ideas along with suggestions for using options to short stocks synthetically. You can learn more about this newsletter here: Short Seller’s Journal information

If only intelligence were measured by the theoretical textbook.

Give me a person with a logic based education and a generous

amount of street smarts. Academics will always be all theory

and no common sense. I remember the Ivy league guys coming

to the exchange and telling all the locals how they were going

to take their money. Well guess how that turned out.

The world is waiting for an event to pull the air out of the housing market. What about a gas price of $10/gallon? After the US attack on Iran.

Holy cheese whiz, did you see the gold to silver ratio ?

It is now 88 to 1 and most interestingly the Dollar has

been moving higher and gold is not really getting smacked.

I’m off to big Kahuna to get a triple cheese burger and a sprite.