As reported on Bloomberg TV: “Barrick Gold Corp was back in favor with fund managers last quarter, before the world’s biggest bullion producer reported disappointing earnings and rising costs…Billionaire investor Stan Druckenmiller’s Duquense Family Office LLC bought 2.85 million shares in Barrick” in the 1st quarter.

Apparently Templeton and Druckenmiller have not done their home work on mining stocks. Anyone with any knowledge and experience investing in mining stocks knows that companies like Barrick and Goldcorp and are poorly managed, highly bureaucratic organizations. As such, they are terrible vehicles with which to express a leveraged view on the precious metals market.

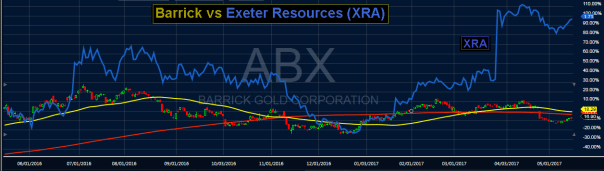

Barrick has all kinds of problems that will affect its profitability, including a pile-on of class action lawsuits that hit recently. Anyone with experience in this sector already knows this. Rather than investing in the largest mining stocks, the best returns in the sector will be made by investing in the companies that will be acquired by these large caps. A good example is the recent takeover of Exeter Resources (XRA) by Goldcorp:

If Stanley Druckenmiller had been a subscriber to the Mining Stock Journal, he would have known to buy XRA in early September (presented in the Sept 1, 2016 issue) at $1.16. The stock popped up to $1.80 when XRA and GG announced the merger. That’s a 55% ROR in 7 months. MSJ subscribers were also shown Mariana Resources in the December 22, 2016 issue at 82 cents. Mariana agreed to acquired by Sandstorm Gold in a deal valued at $1.41. Because of the heavy stock component, SAND traded lower and Mariana traded up to $1.24. A 51% ROR in four months. The new stock idea presented in mid-April is up 19% and has a lot more room to run.

The Mining Stock Journal is a bi-weekly subscription publication that is designed to help you navigate the smaller-cap mining stocks. You can learn more about the subscription service here: Mining Stock Journal information.

After subscribing to Brent Cook for 3 months, I was underwhelmed. Resubscribed to you a few weeks back and sure am glad I did so. You are one the few straight shooters still out there. Keep up the great work. I think we are right on the cusp of a serious market break, thus the war drums. – subscriber “Chris”

Excuse my language Mr Kransler but this globalist fuck and his globalist homies like Soros, another fucking globalist asswipe had intel that Trump would be elected. They sold off everything they had, particularly in GLD which comprised around $250,000,000 in Fuckenmiller’s portfolio.

Others followed suit and all the big money set up a very hard short on the price of gold, lured in the dumb ass long money and then, knowing their intel on Trump victory was 100% solid–better than any politcal election pundit, would have the Ignert Idgits buy into the gold long story. They then crush the market with enormous waves of shorting and smashed gold prices to hell and gone.

Druckenmiller thinks he’s some master of the universe. Got smacked on Barrick? Tough shit loser!

Well said!

As a MSJ subscriber, would you care to comment publicly on Newmont? Been holding that for years, lost and forgotten in an old 401K..

dump it. p.o.s.

Barrick is a p.o.s., not arguing about that, they are complicit in the gold manipulation since the 90s, but just want to point out that ABX still it is up YTD by 5.8%

Does this new contract mean anything? I’ve seen several comments suggesting this is a potentially meaningful development for Gold’s true price discovery.

https://www.metalbulletin.com/Article/3715515/LME-ASIA-WEEK-2017-HKEXs-dual-currency-gold-contract-is-benchmark-Asia-needs-HKEX-says.html

HKEX announced on May 5 that it plans to launch a physically settled CNH (offshore Chinese yuan) and US dollar gold futures contract – the first such pairing on the same exchange platform anywhere in the world. The contract is still awaiting regulatory approval from the Hong Kong Securities and Futures Commission. “We hope that the supervising department will make a decision on the contract in May. Once it gets approval, we will be ready to launch within one to two months,” Zhang said.

Stay tuned – new SoT discusses it