This is starting to smell a lot like 2008. By nearly all private sector reported economic data series, the economy is starting to tank hard. Just today the employment component index of the NY ISM manufacturing report plunged at its fastest pace in history and hit a 7-yr low. A bevy of private sector reports yesterday showed similar trends. Most notably construction spending fell in August – vs. a .7% gain expected. It was the second month in row construction spending declined after a big downward revision pushed July into a decline vs. June. Construction spending is now contracting for the first time in 5 years.

But there’s an even bigger problem to throw in the mix. It’s called “Deutshce Bank.” Despite inexorable pleas to the market by CEO, John Cryan, DB is exhibiting ALL of the characteristics displayed by Lehman in the months leading up to Lehman’s collapse. If DB were forced to undergo an independent – and by independent I mean non-Central Bank, impartial outside third party – audit and a bona fide mark to market of its off-balance sheet “assets,” the bank would be catastrophically insolvent. As it is now, the stock market values DB stock at just 26% of DB’s stated “book value.” It’s true book value is likely negative by at least few $100 billion.

Just for the record, I did “back-of-the-envelope” mark to market analysis on the balance sheets of Lehman, JP Morgan, Washington Mutual and Wells Fargo at the beginning of 2008. This was before I had a blog but I had shared my work with Bill “Midas” Murphy’s Le Metropole Cafe. My work showed that each one of those banks were hopelessly insolvent if accurate mark-to-market accounting would have been enforced on those banks by the regulators. Wash Mutual and Lehman collapsed that year. JP Morgan and Wells Fargo also would have collapsed if the Government had not ripped over $800 billion away from taxpayers and gave it to the big Wall Street banks plus Warren Buffet’s bank.

Deutsche Bank is at least as underwater as each of those banks – and probably more underwater than Lehman and Wash Mutual combined. If the western Central Banks can’t find all of the hidden skeletons in DB’s derivatives closet and clandestinely monetize them, DB will collapse.

Gold is being taken down just like it was in 2008 ahead of some type of systemic disaster coming at us. Gold hit $1020 in March 2008 just as Bear Stearns was collapsing. It was taken down even more during the summer, ahead of Lehman’s collapse. These events should have pushed gold over $2000 back then. Gold eventually almost did hit $2000 by late 2011. The same price management effort is being implemented now and the elitists will do their best to keep gold from broadcasting a loud warning signal to the markets that something is wrong.

Unfortunately, if the masses were allowed to see gold’s “canary” die in the “coal mine” behind the elitists’ “curtain,” it would enable the ones paying attention to get their money out of banks and other monetary custodians before their money is vaporized by whatever financial hurricane is brewing.

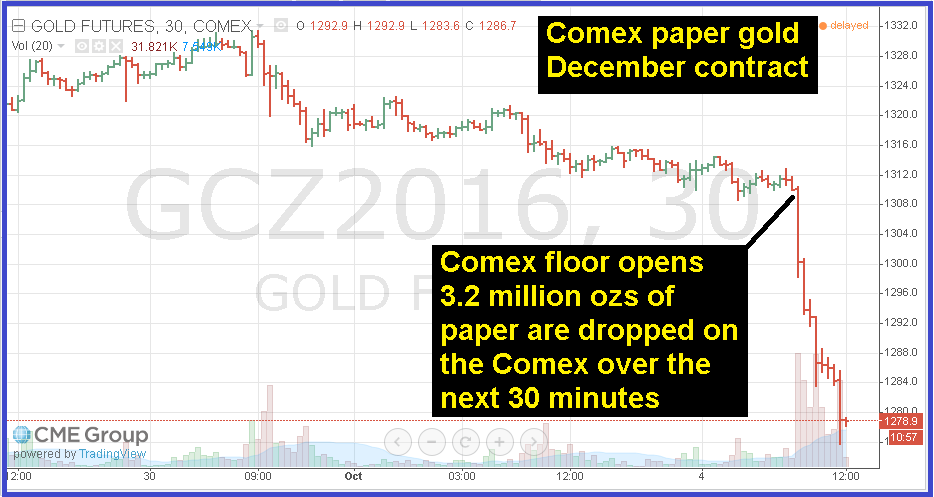

Today gold was smashed right when the Comex floor opened. This is standard operating procedure:

In the first 30 minutes of Comex floor trading, 3.2 million ounces of paper gold “bombs” were dropped on the Comex. Currently the Comex is showing that 2.5 million ozs of gold have been made available in Comex custodial vaults for delivery. Naked short-selling of futures contracts this extreme only occurs in the gold and silver markets. If selling of this magnitude relative the amount of underlying available for delivery occurred in any other commodity, the CFTC would immediately investigate. Not so in gold because the CFTC is part of the elitist team that is charged with price management of gold.

The common “muscle” reaction to a day when gold, silver and the mining stocks are down as much they are now is to sell and run. But this is the wrong reaction. If you want to do something to try and protect what’s your’s, days like today are when money should be removed from banks – especially Deutsche Bank – and moved into the precious metals sector. This may not be the bottom – but it’s close enough for Government work. If you liked mining stocks in early August when the HUI index hit 284 , you should love them now with the HUI at its 200 dma. The HUI has nearly completed a 200 day moving average correction. It might go lower from here but you’ll never pick the bottom.

I use Goldmoney (Bitgold) to accumulate gold on days like today – because I can buy fractionals of an ounce at price that’s close to spot. I moved a fair amount of cash from my checking account into my Goldmoney account today: GOLDMONEY/Bitgold.

Dave,

Something serious must be happening behind the scenes. For gold and silver to be hammered like they have been since late last week it makes me think something big is on the horizon and the TPTB know and are preparing/manipulating the markets accordingly.

The bottom? There is no bottom to paper metals. After starting to stack silver at around 13.00 melt value and watching it bounce around in price up to around 19.00 melt value and the pushed back down again thru market manipulation I figure this will continue till the bitter end. I expected this to occur and I hope metals do go further down in price as I can buy more for less! Always a little giggle knowing I bought silver with paper money. I believe reality will hit eventually and precious metals will take on a life of its own as mining companies and bullion dealers begin to ignore the comex and supply and demand dictate the price.

Thanks for this information and analysis.

” P Morgan and Wells Fargo also would have collapsed if the Government had not ripped over $800 billion away from taxpayers and gave it to the big Wall Street banks plus Warren Buffet’s bank.

I’d love to hear more about that last part. To many Buffet is a “saint”. A white knight of investing wisdom for all of us to follow. A nationally syndicated consumer guru fawned over Buffet a few months ago like he was the alpha and omega of all good in the investing world

Dave: This is excellent; you’ve nailed it. Just as it does to you, this seems far more significant to me than just another of their routine price attacks. This one strikes me as 2008-like ominous.

They are definitely trying to create a massive false illusion, as you have written.

This could also indicate asset dumping to raise needed cash. Perhaps behind the scenes, trades are not settling, and the parties are deliberately keeping it secret to prevent broader panic. I’m not sure if DB has a physical metals position, but if so, maybe they had to dump it to handle cash calls.

Or maybe DB’s counter parties are being told that DB can’t settle with them right now on certain trades, and those counter parties are scrambling to raise the funds they expected to come from DB.

In 2008, the reason commonly given for gold’s fall was liquidity; the gold market always remained functional, even when they couldn’t settle certain equities trades in the high-volume decline.

It could be 100 things, and you are far more the expert in what’s possibly going on behind the curtain than I. But we know one thing: not one of them is good.

Compared to the global equities and debt markets, the metals market is infinitesimal. For them to be so completely focused upon and paranoid about it at this time says it all.

As I write this (around 3:15 PM Eastern), the Dow is down around 0.6%; but gold is being pummeled by 3.5% and silver by 5.6%. So their message is: things aren’t so bad in equities, but you better stay away from metals, because those things are deadly to your financial well-being.

I actually thing you put your finger on their genuine concern at the end of your article. You rightly say, readers need to think seriously about making a switch from banks to metals.

This is what they are absolutely terrified about. More and more people are waking up, and they are thinking exactly along these lines. They know something is terribly wrong, and they cannot see how the problem can be fixed. It might just be a deep, powerful gut feeling on their part; others know the numbers relating to the economy, banking system and the like, so those people know for a fact that there’s no way out of this. Anyhow,

I think the “collective consciousness” of trouble is on the move big time, in an already large and fast-growing cohort of the population … not just here, but even more so in Europe, where they are much more attuned to bank runs, hyperinflation and currency crises, having been through them so harshly in the past.

People are waking up; their minds are in motion. More and more are saying, “I need to do something. This whole situation just doesn’t feel right.” Of course, they are 100% correct. Now, they are starting to believe in their own instincts, as opposed to the propaganda that is put in their heads every day to make them doubt their instincts.

As we know, if the owners of even 2% of bank deposits decided to redenominate those funds in metals, the impact on both the banks and the metals market would be epic. The Treasury, Fed and bankers are acutely aware of this. They’re running out of time; they know this, too. They are LIVID with themselves that they didn’t start the cashlessness ball rolling sooner, and that it is not already in place. So they can’t stop bank balances from bleeding into metals. All they can do is create phony prices for metals, and hope this scares the hell out of people who are thinking about moving into them. They are buying some time, to figure out how to implement emergency measures to control the people’s money.

Your advice to readers that they better get a move on, whatever they decide to do, is the most valuable advice they are going to hear from anyone. There is not one thing happening in the markets right now that is natural, or good.

Thanks again for the great article.

What they’ve done to silver is quite a sight to see! Of course, silver is more volatile than gold as a rule. It does validate my earlier comment about picking up generic silver rounds though. I myself picked up a small amount of them. But I did it well before COMEX even opened @ what seemed like a cheap hammered down price @ that time, LOL! Little did I know of the madness that lied ahead.

But I’m not losing sleep for even 1 single second for not having foreseen today’s catastrophically desperate slamdown, and not picking such a low “bottom”. That’s because I know for sure the severe magnitude of the impending storm. By the logic in my own comment earlier, I haven’t lost anything.

Another point to note BTW :

China is totally shutdown for entire week called Golden Week. (Usual National Day in China of October 1 fell on weekend, so starting October 3 on Monday.) Since Shanghai physical market is closed, it gives that much immunity and boldness for the criminal rats to wreak havoc in paper markets. I realize any discussion of arbitrage only makes sense when both disconnected markets are open. But for amusement sake, if you checked out what the arbitrage paper-physical spread looks like now, it’s in an insane category. For gold it shows leaning into heavy caution territory. For silver it’s almost in the “market collapse” category, because that’s what the rats have literally caused.

What are all these COMEX-LBMA paper rats going to do when Shanghai opens next Monday? Of course after such a long break, you expect their market to have gaps…..But gaps of such CATASTROPHIC magnitude?!? Either the paper rats put on a managed retreat by Friday, OR the Chinese simply put their head down on Monday & get on with the charade as if nothing happened, followed by eventual price increase(s).

“….. OR the Chinese simply put their head down on Monday & get on with the charade as if nothing happened, followed by eventual price increase(s).”

But before prices increases they will have bought tons of physical metal

Holy shit, Andrew McGwire says they dumped 1000 tons of paper gold today! What happened today is an event one for the ages!!!! Utterly flabbergasted by the sheer extremeness of this, it’s mind numbing.

http://kingworldnews.com/andrew-maguire-a-staggering-1000-tonnes-of-paper-gold-rinsed-out-of-the-market-today/

What kind of Satanic logic would permit someone to run software algorithms to dump 1000 tons of non-existent gold? Let October 4 be commemorated as some sort of Dark Day. Similar to Nazis seizing the Reichstag in January 1933.

Were the Romans this crazy?

What about Ghenghis Khan?

Had Napolean lost his sanity to this extent at the height of his arrogance??

Were the Nazis this crazy???

Thanks for the great article…I smelled a RAT bigtime last Thursday night, well, the next morning, when German Bank Crisis SHOULD have made the DJIA drop 300-800 points, and Gold UP 25-60 bucks, but, NO…DJIA UP 165, gold down 4 dollars….something is so wrong, and, it is soooooo obvious, even to a beginner like me, it’s not funny.

So, yes, I’m moving cash into Bitgold(now called Goldmoney), from checking(My Bank is IN america, but, owned by a Large French Company, so, need to be even more nervous…it’s the one with a “bear” as a logo)…when my investments get back to even with them, in the trading platform, I don’t want to, but, will sellout, and, transfer cash elsewhere, most into Goldmoney.

Still moving fiat currency into GoldMoney with this monkey hammer down. You know, cost averaging LOL. Just buy gold, doesn’t matter the current price, but sure nice to get some sub 1,300.

LOL I moved twice today – once in the morning with gold down $26 and once in the afternoon with gold down $40

They can play as long as they want (temporary) , but they know that price of gold only can go higher.

This is very good chance for them to increase investment in gold , silver mining companies.

USA imported 60 tons of gold lately , they were preparing themselves for this event to have back up for Comex.

The reason for the downward price movement is the last two days in the London afternoon session currencies traders were shorting the hell out of EUR/USD and GBP/USD causing dollar strength which equates to commodity weakness including gold and silver. Yesterday when the traders at the Comex saw the EUR/USD cross bust thru the 1200, they realized they were going to move it lower hence the shorts were added riding price weakness back down. The cross actually went around the 1150 level and as expected bounced up to the 1230 level but the HFT algos at the Comex didn’t move the gold price back up as they typically do. Now the cross is at 1206 so I am assuming that more shorts are going to be added and they will ride price weakness further down.

Regarding moving cash to Goldmoney, any idea whom their banking partner is? Any counterparty risk on the cash side?