Investment Research Products

Powered by Kranzler Research

Articles

“Gold Prices Fall Just In Time For Diwali”

Holding physical gold and silver remains the primary hedge in preserving the purchasing power and liquidity of one’s wealth and assets in the difficult times ahead. The hedge needs to be held into and through the crisis, in order to provide its full benefit. – John Williams, Shadowstats.com

I can’t figure out if the Fed/Wall Street bullion banks understand that every time they smash the price of gold with fraudulent paper gold contracts, it creates massive physical delivery demands in India and Asia. But based on the market data in India/Asia, it would appear that the latest price take-down of gold has aroused the a sleeping gold giant in India.

The western banker gold cartel has made about a billion Indian really happy. The paper gold price-management mechanism used to knock down the price of gold these past few weeks has stimulated a ground-swell of demand for imported kilo bars into India.

For the first time in several months, the ex-duty price of gold in India has been high enough to trigger heavy importing of kilo bars into India this past. This is in addition to the heavy flow of dore bars and smuggled gold – the amount of which is completely ignored by the World Gold Council’s accounting of India’s imports.

The same is true for Asia: “Individuals as well as business were picking up physical gold, as they see this pullback as an opportunity,” said Brian Lan, managing director at Singapore-based gold dealer GoldSilver Central – LINK.

As with every case of Central Bank/Government market intervention, unintended consequences always emerge to make the “problem” at which the intervention was directed even worse. In this case, artificially lower gold prices have prompted a surge in eastern hemisphere buying.

These eastern Central Banks have been busy dumping Treasuries over the last 18 months. It’s likely that they will use this opportunity to convert even more Treasuries into physical gold.

As John Brimelow, of the highly regarded “John Brimelow Gold Jottings” asserts: “‘Someone” is going to have to work a great deal harder next week with China back and India in action, really for the first time this year both have been buyers.

A “Cat 5” Financial System Hurricane Swirls Offshore

One of the biggest benefits I get from writing newsletters (Mining Stock and Short Seller’s Journal) is that I get “grassroots Main Street” intel from subscribers. This has led to some invavluable insights into the housing market and the general economy all over the country.

Yesterday I received this email:

Heard from a friend east of the Atlantic that things are worse than are even being reported by alternative media. I bet the only thing the banks would like more is if the Chinese took another week off! I also heard next week could be big trouble.

My friend’s employer is a financial institution in Europe – you can probably guess which country. Words used were “chaos” and “possible shutdown.” Advised to buy silver as much as possible.

I tried to pull more info out of him but he was understandably compelled to pass on generalities in order to protect the identity of his friend.

Having said that, the information is consistent with what is unfolding at Deutche Bank. It also dovetails with the systematic take-down of gold. I’ll have more on that later today. Interestingly, the media attention has focused on DB. But the stock market is telling us that Credit Suisse has huge balance sheet problems as well:

Both DB and CS have significantly underperformed the benchmark bank index since early March. The index is composed of U.S. Too Big To Fail and super-regional banks. With all the “smoke” coming from DB, it’s entirely possible that Credit Suisse is either inextricably tied to the fate of DB via a perilous derivatives counterparty relationship or CS has catastrophic problems of its own that swirling around but receiving less media attention.

The reality is that all of the U.S. Too Big To Fail banks are also inextricably tied to DB through OTC derivatives counterparty relationships. DB was excessively aggressive in underwriting exotic energy-related derivatives both in the U.S. and Canada (this comes from an inside source of mine), which means that JP Morgan and Citi, specifically among several others, are tied to DB’s fate.

As detailed here, Deutsche Bank received two bailouts from the Fed and the Government approaching $100 billion in 2008: U.S. Taxpayers Bailout DB. Without question, this is because the big U.S. banks are tied at the hip to the fate of DB.

I have no doubt that Fed is using its resources to help the German Government and the ECB keep DB propped up for now. I also have no doubt that there are huge hidden financial bombs at DB that the Fed et al will be unable to locate before they detonate. I would suggest that notion is reflected in the warning above passed on to me yesterday.

Will Hurricane Matthew Trigger A Derivatives Melt-Down?

“Catastrophe swaps” – aka “weather derivatives” – are an obscure derivatives “Frankenstein” created under the auspices of helping property & casualty insurers and re-insurers to “transfer” a portion of the risk on a portfolio of catastrophe insurance to the “marketplace.”

In reality, it was just another Wall Street mechanism designed to generate huge fees for Wall Street derivatives bankers. Without a doubt, just like financial market OTC derivatives and “portfolio insurance,” these derivatives were significantly underpriced relative to the true statistical expected value of the contract. After all, if the cost of weather catastrophe protection carries a high premium, it wouldn’t generate much sales volume and thus wouldn’t generate fees for Wall Street.

As you can imagine, a hurricane can cause a lot of property damage. From ripping the roofs off homes to blowing down walls, homes can be ruined in a matter of minutes. After the hurricane passes, repairs need to be made by professionals like those from a Blue Ladder Roofing Company as well as plumbing companies, electrical companies, and sometimes even landscaping companies if trees have been uprooted. These repairs are essential if a family wants to return to their home. Thankfully, some families have hurricane insurance which can help cover the cost of repairs but sometimes things don’t always run smoothly. Hurricanes can lead to a lot of complications when it comes to insurance disputes and companies handing out money to property owners. This often causes insurance prices to rise more and more over the years. However, Florida has addressed the problem of the cost of hurricane insurance by creating a State run insurance fund – the Citizens Property Insurance Corporation – to provide hurricane insurance to those who could not otherwise afford to pay the premiums in the private insurance marketplace. Notwithstanding the fact that anything like this run by any government will eventually lead to undesirable results, the fact that cost of hurricane risk insurance had to be socialized in Florida reflects the fact that the expected value of the cost of insuring against hurricane damage is higher than most households can afford. Some people can find deals on sites like Covered, but this is not universal.

The truth is, if you can’t afford the cost of hurricane insurance, that you should not be living in home that is potentially subjected to hurricane damage. Move inland. A lot of the damage may not be totally devastating but may involve something like a damaged gutter that has either been broken or clogged with debris from the storm. In this case, Floridians living on the east coast may want to look towards something like the services from Clean Pro Gutter Cleaning Fort Lauderdale in order to repair or clean the affected gutter.

But Wall Street decided to “fix” this problem by rolling out weather derivatives. The entities who would want to buy protection from a hurricane would be insurance companies – like the Citizens Property Insurance Corporation. The entities who would take the other side of that would be, of course, hedge funds. For Wall Street, the trick in pricing the cost of these derivatives is to find the price-point at which buyers would be willing pay for it – so it has to be less than the cost of re-insurance – and the price-point at which hedge funds would be tempted to take the risk in exchange for cash upfront.

It’s a three-headed greed monster: Wall Street, insurance companies and hedge funds.

These derivatives enable insurance companies to take on higher risks than they would otherwise if these products were not available, or were priced properly, and they enable hedge funds to take in cash to use in other speculative endeavors. And they let Wall Street whores skim large fees – all for a price that everyone can live with.

That is, of course, until an event occurs for which the probability of that event occurring was not properly priced into the equation. If the true risk embedded in exotic OTC derivatives were priced into these products, no one would buy them.

Just like the “portfolio insurance” of the 1980’s, the “hedge” models used by Long Term Capital Management and the derivatives pricing models used by entities that were blown up by mortgage derivatives less than ten years ago, these weather derivatives are going to blow a big hole in some insurance companies and hedge funds if Hurricane Matthews is what it’s reported to be. It’s called “counterparty default.” It’s Jame Dimon’s “tempest in a teapot” that all of a sudden blew apart the teapot.

Capital Management and the derivatives pricing models used by entities that were blown up by mortgage derivatives less than ten years ago, these weather derivatives are going to blow a big hole in some insurance companies and hedge funds if Hurricane Matthews is what it’s reported to be. It’s called “counterparty default.” It’s Jame Dimon’s “tempest in a teapot” that all of a sudden blew apart the teapot.

If Matthews inflicts the kind of damage on the east coast of Florida that is now being predicted, there will be hedge funds who will be unable to make payments when the insurance companies come to collect on their side of these weather derivatives agreements. The most interesting to watch will be the Florida State fund. If its reinsurance and weather derivatives counterparties default on payment, the State of Florida could end up in serious financial trouble.

On the private insurance side of this, there’s no doubt that P&C companies underwrote risks that they may not have underwritten if weather derivatives were not available. But in addition to buying catastrophe swaps, portions of the exposure would have been laid off on reinsurance companies. When claims pour in that exceed the amount set aside for those claims, the insurance companies will look to the re-insurance companies for payments who will turn to hedge funds who underwrote the weather derivatives. When the hedge funds default on these claims, that’s when the fun begins.

An Open Letter to Elizabeth Warren on Gold Fraud

The letter posted below is from Stewart Dougherty. Elizabeth Warren on the surface purports to represent middle class interests by associating herself with the erection of the Consumer Financial Protection Bureau. But she has turned out to be another faux populist who panders to the public in order to generate voter support and, in reality, sides with the rest of her cronies and looks other way while Corporate America steals our wealth.

The Consumer Financial Protection Bureau is a Trojan horse device which superficially appears to protect the public from Wall Street but in reality does nothing more than provide a false sense of security. It’s another useless bureaucratic mechanism which serves no purpose other than to create another Government department that vacuums up taxpayer money and employs people who are otherwise unemployable in the private sector.

I ask you this, dear Elizabeth, if your Consumer Financial Protection Financial Bureau serves any purpose, how on earth did Wells Fargo’s billions in checking account fraud go undetected. I suspect another person with “Warren” in their name had a hand in encouraging you to leave Wells Fargo alone.

And speaking of Wells Fargo, the show you put on the other day verbally “pistol-whipping” Wells Fargo CEO, John Stumpf, was highly entertaining. But unfortunately, your words are tougher than your actions. Based on the financial regulations (see FINRA, please) that are in place to punish those caught committing financial market illegalities, Stumpf can be held legally responsible for the actions of those below him – his “agents” is the technical term in case you’ve never studied financial regulations.

The size of what occurred at Wells Fargo qualifies Stumpf and his henchman to be indicted with felony charges. I recall in 1988 that the Justice Department threatened Drexel Burnham Lambert with RICO charges for its felonious actions. Of course, that was an era when Congress was not completely captured by Corporate America.

I’m sure your theatrics helped increase your support base in Massachusetts. It’s too bad no one will hold you accountable. I also see that your 2nd and 6th largest sources of campaign funds come from laws firms who represent Wall Street banks and from Wall Street itself: Elizabeth Warren campaign donors.

And speaking of being held accountable, maybe you can explain why you oppose any legislation that would force an open, independent audit of the Federal Reserve. I understand why you won’t go after Stumf and Wells Fargo beyond verbal castigation, but your position on an Fed audit ceaselessly baffles me and all of my colleagues…

Dear Senator Warren:

On September 20, 2016, you appropriately excoriated CEO John Stumpf about the consumer fraud that took place at Wells Fargo Bank. Again and again, you used the word “scam” to characterize Wells Fargo’s actions, and this was the proper word for you to use. It was a scam, plain and simple.

Over a period of several years, Wells Fargo created more than 2 million accounts to flatter its numbers and increase its stock value, thereby increasing the value of senior executives’ stock options.

Many of the phony accounts were dormant and incurred no fees, but certain other accounts, such as credit cards, did incur fees.

Erring on the side of excess, let’s assume that the actual cost to Wells Fargo customers was $1,000.00 per phony account. This would mean a $2 billion fraud, in total. If we assume that these accounts were created over a 5 year period (it was probably longer), the scam would have amounted to roughly $400 million per year.

This $2 billion consumer fraud has correctly inflamed members of Congress, making you and your Capitol Hill colleagues irate, as we witnessed during the fiery House and Senate hearings.

Yesterday, October 4, 2016, a different kind of consumer fraud occurred. But this one was more than 100 times greater in amount, in ONE DAY, than Well Fargo’s entire multi-year fraud.

This fraud resulted in the theft of $246,758,400,000.00 ($246.8 BILLION) from people all over the world.

This SCAM affected rural farmers in India; common villagers throughout Africa; elderly retirees in Japan; young newlyweds in China; small shop owners in Tibet; flower merchants in Peru; nurses in Argentina; school teachers in Canada; and people of every type of vocation and station in the United States.

This SCAM hurt people of every single socio-economic class; every race, religion and creed; every age; every ideology, political and otherwise; and every other imaginable human description. And it hurt them in every single nation throughout the entire world. The common strand connecting hundreds of millions of people fleeced by this SCAM is that they are simple, ordinary, everyday human beings trying to enjoy a decent life and future.

From facts documented for more than a decade by formal researchers such as those at an organization known as GATA, we know without a shadow of doubt that this SCAM emanates from the United States, even though it affects people throughout the world.

What we witness is massive, condoned, formal, organized Wall Street theft. And since this type of theft has been happening for years with no Congressional or regulatory action of any kind against it, it also constitutes state sponsored financial terrorism, deliberately intended to inflict financial harm on innocent, honest, hard-working, everyday citizens worldwide.

From the dawn of human civilization, man has searched for honesty in all its glorious forms. Honesty is what makes civilization possible in the first place. When there is no honesty, civilization disintegrates. Where only dishonesty, corruption and deceit prevail, chaos and inhumanity rule.

One of the basic forms of honesty sought by humanity from the beginning was a reliable, truthful money. Honest money is a critical prerequisite to a functioning civilization. Early people discovered such a form of money, and their discovery was so powerful that it has reigned uninterrupted in the mind of man and in markets for more than 5,000 years.

It is called Gold, and perhaps you own some yourself. Perhaps you received it as a keepsake handed down to you by a parent or grandparent, with all its sentimental powers. Perhaps it is a beautiful piece of jewelry given to you by a loved one or yourself, or perhaps you saw a gold coin one day and purchased it for its value and its beauty. Those who own gold cherish it, and I would imagine you cherish yours, too, if you have some.

During this period of 5,000 years, by honest toil, deployment of capital and engineering brilliance, mankind has brought forth from the earth 183,600 metric tonnes of gold, or nearly 6 billion troy ounces. This amounts to not quite 1 troy ounce for every person on earth. In fact, if everyone wanted to own gold equally, they could only possess is 0.77 troy ounces of it. So we see how rare it truly is, despite 5,000 years of struggle to find, mine and distribute it.

Yesterday, October 4, 2016, a day that will live in infamy, the price of gold was crushed $42.00 per ounce by the financial elite (or, what I call, the “eleech”), with full state blessing, for the dual purposes of monetary enforcement and outright theft. The perpetrators of this SCAM walked away with hundreds of millions of dollars of direct, private profits, which they always do when they conduct these repeated attacks on the price of gold.

The citizens of the world were not nearly as fortunate as the fraudulent and thieving eleech. 5.875 billion ounces of gold lost $42.00 per ounce in price, for total global wealth destruction in the amount of $246,758,400,000.00, aka 246.7 BILLION dollars, on that date.

This constitutes one of the largest, outright, one-day THEFTS in human history. History’s other record-setting thefts also cluster around this exact form of fraud, which has been happening now for decades with no Congressional or regulatory action of any kind whatsoever taken to stop it.

Aside from providing a risk-free ability for the Wall Street eleech to steal hundreds of millions of dollars from people around the world, with zero risk of facing any type of criminal charge at all, the purpose of these price attacks on gold is to scare people away from owning it.

The for-profit Central Bankers have monopoly products called fiat currencies. These currencies are deliberately designed to diminish in value. We know this for a fact, because one of the mandates of the Federal Reserve Bank is to create inflation. They actually tell us this in plain English. They want us to believe that the gravest monetary problem we face today is that there is insufficient inflation, and that higher prices would be a great benefit to Us, the People. Naturally, this kind of brazen, self-serving lie is an insult to the People’s intelligence. The people are not stupid, and it is a grave error when politicians, officials and/or the eleech think we are.

People all over the world are waking up to the fact that fiat currencies are a serious danger to their financial well-being, and they are looking for alternatives in order to avert this danger. Historically, tangible things, including precious metals, are a way to achieve this. Given your focus upon matters financial, Ms. Warren, surely I’m not telling you anything you don’t already know.

Monopolists everywhere despise the idea of their monopolies being challenged. They are particularly fearful when the truth starts to leak out about a monopoly product that is drowning in fraud, corruption and lies, and that is defective. When it comes to human perception and understanding, a spark can become a firestorm in the collective consciousness in the proverbial wink of an eye. The absolute last thing corrupt monopolists can permit is a Great Awakening.

For years, and particularly since 2011, when precious metals market forces impressively began to break free and exert themselves, there has been a systematic effort to smash their prices. The technique used to do this is to dump millions of ounces of nakedly shorted paper metals onto the markets in a matter of seconds or minutes, creating a price avalanche.

This is deliberate price manipulation, and therefore fraud. It delivers a handful of eleech insiders huge financial gains, at the expense of everyone else, while also advancing a diabolical and thoroughly dishonest monetary agenda.

This has happened literally hundreds of times over the past four decades, but the problem is getting worse. Apparently, the perpetrators are getting addicted to the huge sums of money they can steal in a mere few hours. It also tells us that the monopolists at the Central Banks are getting very worried about something. Therefore, they are deliberately creating phony metals prices in order to confuse, deceive and create false illusions among the public about their defective monopoly products.

Senator Warren, you have shown extreme interest in and moral repulsion over the $2 billion Wells Fargo SCAM, so I would imagine the $247 billion one-day, oft-repeated SCAM that I have outlined above will pique your interest, too. Yes? I certainly hope so.

On a broader, closing note, Ms. Warren, when one views the current landscape, it appears that our leading national export is Wall Street greed and fraud. This greed and fraud brings shame upon and disgrace to our nation. To any sentient person, it is repulsive. Having watched you grill Mr. Stumpf, I know this kind of avarice and corruption is particularly repulsive to you.

My belief is that the people of the world are waking up to how the Wall Street eleech are financially hurting them, and that the people are rightly getting angry about it. Our standing in the world appears to diminish every day, in large part due to the financial abuse that a tiny, arrogant, greedy, corrupt cabal of American moneysuckers inflict upon decent people throughout the world. The egregious manipulation of gold market is a glaring, nationally embarrassing, “poster child” example of this abuse.

You can help your country and its citizens right now by focusing your energy, intelligence and sense of ethics upon this disgraceful crime.

I will let this message sink in for a day or two, and will then contact you so we can discuss it in further detail, and speak about how this abuse can be stopped.

Respectfully, Stewart Dougherty

October 5, 2016

Does The Attack On Gold Signal An Imminent Bank Collapse

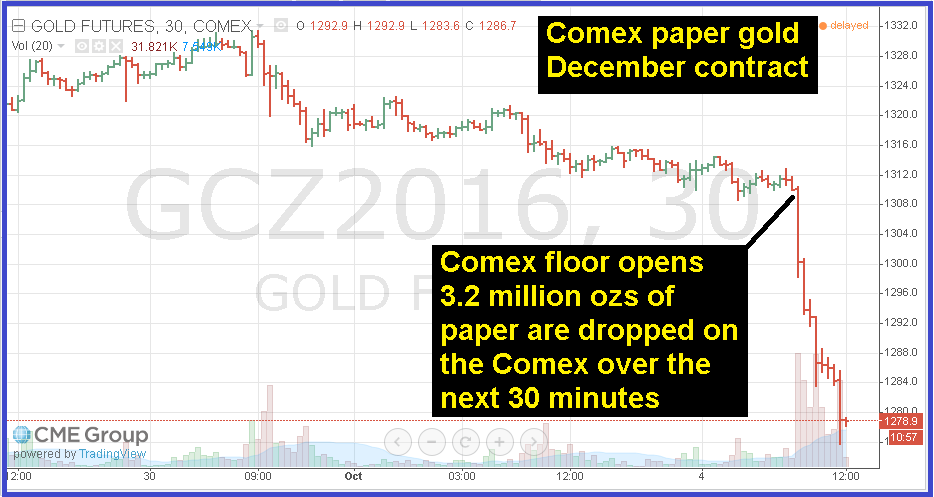

Since August, the gold price managers – aka “the gold cartel” – have been regularly dumping a lot of paper gold onto the Comex when the Comex floor opens at 8:20 a.m. EST. It’s been their standard operating procedure for the better part of the last 15 years. The fact that the world’s largest gold buyer – China – is closed all week for a holiday observance takes away the biggest physical market bid for five trading days, making it easier to smash down the price of gold using fraudulent fiat paper gold.

It’s hard to ignore that the events in the financial and economic system unfolding now are not unlike the events that occurred prior to the 2008 “great financial collapse,” which was a de facto western banking system collapse. The U.S. and European economies are contracting, the housing market is beginning to crumble (see this – link – for instance), the auto market is headed south as auto loan defaults are headed north and it would appear that the middle class consumer is out of disposable income. There are plenty of other factors that make this time around much worse than 2008, but we’ll save discussion of those for another day.

It’s also hard to ignore “quacking” coming from Deutsche Bank. It would appear that DB is on the ropes financially. The incessantly repetitive denials of any problems coming from Central Bankers and the DB upper brass make the “quacking” even harder to ignore. If it looks, sounds and operates like a collapsing bank…well, it’s probably a collapsing bank.

There’s no doubt that the recent take-down of gold and silver – especially today’s – is inextricably connected to some sort of financial system disaster brewing. In today’s Shadow of Truth, we discuss the massive hit put on gold and reasons why it’s likely an operation implemented to prevent gold from alerting the public that a potentially catastrophic financial hurricane is swirling around “offshore.” After all, it is hurricane season:

This email from one of Dave’s Mining Stock Journal subscribers is yet another indication that something ugly is unfolding with Deutsche Bank:

I have a very good friend who has been a financial market professional for almost 40 years. He’s very knowledgeable about the monetary system and the general state of the world economy. Last week, he was in Europe on business. His trip ended in Brussels, so he flew home from there on Saturday (this past weekend). He has zillions of frequent flyer miles, so he always travels in First Class. As he flew home this past Saturday, he noticed that there were a bunch of people in his section, and they were travelling as a group. Based on conversations he could overhear, it seemed that they were heading to the US for some sort of an emergency meeting about Deutsche Bank. One woman connected with the group approached my friend (under the mistaken impression that he was part of the group). She started to thank him for being able to get free on such short notice to attend the meeting. She didn’t say where the meeting was going to be held, but she did briefly mention the name of the group with which she mistakenly thought my friend was travelling. Unfortunately, he can’t recall the name, but it sounded like it had something to do with the EU. My friend let her rattle on for about 45 seconds before he politely informed her that he was not part of the group. The lady turned beet-red and clammed up immediately!

Gold & Silver Slammed At Comex Open: Something Bad Is Coming

This is starting to smell a lot like 2008. By nearly all private sector reported economic data series, the economy is starting to tank hard. Just today the employment component index of the NY ISM manufacturing report plunged at its fastest pace in history and hit a 7-yr low. A bevy of private sector reports yesterday showed similar trends. Most notably construction spending fell in August – vs. a .7% gain expected. It was the second month in row construction spending declined after a big downward revision pushed July into a decline vs. June. Construction spending is now contracting for the first time in 5 years.

But there’s an even bigger problem to throw in the mix. It’s called “Deutshce Bank.” Despite inexorable pleas to the market by CEO, John Cryan, DB is exhibiting ALL of the characteristics displayed by Lehman in the months leading up to Lehman’s collapse. If DB were forced to undergo an independent – and by independent I mean non-Central Bank, impartial outside third party – audit and a bona fide mark to market of its off-balance sheet “assets,” the bank would be catastrophically insolvent. As it is now, the stock market values DB stock at just 26% of DB’s stated “book value.” It’s true book value is likely negative by at least few $100 billion.

Just for the record, I did “back-of-the-envelope” mark to market analysis on the balance sheets of Lehman, JP Morgan, Washington Mutual and Wells Fargo at the beginning of 2008. This was before I had a blog but I had shared my work with Bill “Midas” Murphy’s Le Metropole Cafe. My work showed that each one of those banks were hopelessly insolvent if accurate mark-to-market accounting would have been enforced on those banks by the regulators. Wash Mutual and Lehman collapsed that year. JP Morgan and Wells Fargo also would have collapsed if the Government had not ripped over $800 billion away from taxpayers and gave it to the big Wall Street banks plus Warren Buffet’s bank.

Deutsche Bank is at least as underwater as each of those banks – and probably more underwater than Lehman and Wash Mutual combined. If the western Central Banks can’t find all of the hidden skeletons in DB’s derivatives closet and clandestinely monetize them, DB will collapse.

Gold is being taken down just like it was in 2008 ahead of some type of systemic disaster coming at us. Gold hit $1020 in March 2008 just as Bear Stearns was collapsing. It was taken down even more during the summer, ahead of Lehman’s collapse. These events should have pushed gold over $2000 back then. Gold eventually almost did hit $2000 by late 2011. The same price management effort is being implemented now and the elitists will do their best to keep gold from broadcasting a loud warning signal to the markets that something is wrong.

Unfortunately, if the masses were allowed to see gold’s “canary” die in the “coal mine” behind the elitists’ “curtain,” it would enable the ones paying attention to get their money out of banks and other monetary custodians before their money is vaporized by whatever financial hurricane is brewing.

Today gold was smashed right when the Comex floor opened. This is standard operating procedure:

In the first 30 minutes of Comex floor trading, 3.2 million ounces of paper gold “bombs” were dropped on the Comex. Currently the Comex is showing that 2.5 million ozs of gold have been made available in Comex custodial vaults for delivery. Naked short-selling of futures contracts this extreme only occurs in the gold and silver markets. If selling of this magnitude relative the amount of underlying available for delivery occurred in any other commodity, the CFTC would immediately investigate. Not so in gold because the CFTC is part of the elitist team that is charged with price management of gold.

The common “muscle” reaction to a day when gold, silver and the mining stocks are down as much they are now is to sell and run. But this is the wrong reaction. If you want to do something to try and protect what’s your’s, days like today are when money should be removed from banks – especially Deutsche Bank – and moved into the precious metals sector. This may not be the bottom – but it’s close enough for Government work. If you liked mining stocks in early August when the HUI index hit 284 , you should love them now with the HUI at its 200 dma. The HUI has nearly completed a 200 day moving average correction. It might go lower from here but you’ll never pick the bottom.

I use Goldmoney (Bitgold) to accumulate gold on days like today – because I can buy fractionals of an ounce at price that’s close to spot. I moved a fair amount of cash from my checking account into my Goldmoney account today: GOLDMONEY/Bitgold.

Deutsche Bank Will Collapse Without A Bailout or Bail-In

Currently the fate of Deutsche Bank is the most discussed topic in the financial markets. The stock price is rumor-driven, the most recent of which were unsubstantiated rumors of a settlement with the Justice Department that drove the stock up 14% last Friday. As it turns out, the bank has not yet initiated face-to-face settlement discussions.

The gyrations of this stock are like the exaggerated “wobbles” of a spinning top right before it drops the floor (or table-top). Make no mistake, DB will collapse absent a bailout by the German Government – likely in collusion with the Fed, ECB and BoE – or a bail-in by creditors, including depositors.

The cost to buy credit protection on DB’s junior debt moved up to a new record high today. Certainly the OTC derivatives market is not convinced that DB CEO, John Cryan, is being forthright in his pleas to the market proclaiming that everything is under control. Judging from the timing of similar remarks make by Bernanke in reference to the mortgage market and by the CEO’s of Bear Stearns and Lehman, DB could be just a few months away from total collapse.

I wanted to share my comments on DB that I included in my weekly Short Seller’s Journal, released last night:

On Thursday last week, DB hit another new all-time low – $11.19 – intra-day Thusday. It closed that day at $11.48, another new all-time low close. Miraculously, a new rumor hit the tape on Friday in which a French media organization tweeted out that the Justice Department and DB agreed to settle the $14 billion mortgage fraud fine levied earlier this month for $5.4 billion. The stock shot up in frenzied short-covering to close @13.09, up 14% from Thursday’s all-time low close. Of course, the French news source back-pedaled away from the certainty of its tweet later in the day.

The false rumors are intentionally dropped on the market to incite hedge fund short-covering. There is still a lot of “big money” trapped in big positions in DB stock. The short-covering activity creates a bid into which insiders and those connected to insiders can unload big positions. Over 70 million shares traded on Friday. This was 3.5x the 10-day average daily volume of 21.8mm shares per day and more than 10x the 90-day average volume of 6.9mm shares per day. In other words, Friday’s activity enabled a lot “trapped” longs to move closer to the exit (unload their positions).

A much better indicator of what’s going on “behind the curtain” at Deutsche Bank is the report that several hedge fund clients of DB’s withdrew any excess cash held in custody at the banks. This fact was confirmed by the CEO. The other indicator is the cost in the derivatives market to buy default insurance on DB’s bonds. On Friday – even after the French media rumor was floated – the cost buy 1 year default protection on DB’s junior bonds soared to over 600 basis points. To put the cost of this in context, the 1-yr rate on U.S. Treasury bonds is 59 basis points (0.59%).

In terms of U.S. Corporate bonds, any company that has to pay 6% to borrow money for one year is likely headed toward bankruptcy. Think about the rate you are paying on your auto loan, if you have one. It’s probably in the 2-4% range. The derivatives market has determined that lending money to Deutsche Bank is riskier than lending money to you…

Turkey is not taking over DB and DB was technically insolvent before the Justice Department threw a $14 billion mortgage fraud fine at the bank. Too be sure, if a settlement is announced, I recommend shorting DB after waiting for DB to spike up on that announcement. Too be sure, eventually the German Government, likely in conjunction with the ECB and the Fed, will be forced to bailout DB. DB’s derivatives holdings alone are several times larger than Germany’s GDP. And that’s the liabilities that are visible. I can guarantee that, having worked on a trading desk that often hid positions from internal regulators using derivatives, that DB has a lot of unknown skeletons in the closet. I guarantee that.

This up/down rumor-driven trading in DB stock is exactly like the trading that occurred in Enron and Bear Stearns. I shorted Enron in the $40’s and covered it at $12. I covered too soon obviously because of spike-ups on rumors that occurred as the stock approached $10. Same with Bear Stearns, which I shorted in the $20’s. If/when a bailout occurs, it won’t happen until DB stock is well below $10 if not $5.

As for the hidden skeletons lurking underneath DB’s published financial statements, here’s another one that popped out and it’s just the tip of the iceberg: Deutsche Bank Charged Over Paschi Accounts As Legal Hits Mount – Bloomberg. If you read the article, you’ll note that Monte Paschi used derivatives trades with Deutsche Bank to hide losses from previous derivatives trades that DB stuffed into the Italian bank. This is exactly the type of activity I witnessed going on at Bankers Trust before DB bought BT. Then DB took the same operational algorithm and increased the use of it exponentially.

If you bank with Deutsche Bank, you need to get all of your cash out of any accounts there immediately – unless you don’t care about money. In fact, other than loans you have from Deutsche Bank, I would close any accounts you have with the bank, including and especially any assets held with its wealth management group.

There will be no justice served to the people who made $100’s of millions in compensation from DB (see disgraced former CEO, Anshu Jain) through fraud – fraud which has and will result in $100’s of billions of wealth destruction. But you still have time to step-aside and watch the fireworks show from the sidelines.

Willem Middelkoop: The New SDR Will Lead To Gold And Silver Shortages

My Shadow of Truth partner has posted a compelling interview on his Daily Coin website with Willem Middelkoop. “The Chinese are not too happy about the current dollar world reserve system and have been quite open and vocal about their wish to change the existing monetary system toward a next phase…”

The Fall of the House of Fraud (And Peak Corruption)

Peak Corruption represents the terminal phase of any business, social system, government or collective entity of any kind. Peak Corruption is absolutely and by definition the end of the road. – Guest post by Stewart Dougherty

Guest post by Steward Dougherty – The United States has transitioned from a Republic, to a Democracy, to a Crony Capitalist Oligarchy, to its present state: a thinly disguised Monarchy.

This monarchy is ruled by the the American House of Fraud, the nation’s Royal Family. The House of Fraud is populated by a small group of individuals who live like kings and queens by systematically plundering the wealth of the nation.

While members of Royal Families are typically linked by blood, the members of the American House of Fraud are linked by psychological characteristics. To become a member of the American House of Fraud, one must demonstrate exceptional levels of greed; sanctimony; power-lust; shamelessness; compulsion to control; love of wars-for-profit; lack of conscience; self-righteousness; egomania; and superciliousness: in other words, psycopathy.

The mantra of The House of Fraud is: “Never Enough.” No matter how much money they plunder, no matter how many people die in their wars for profit, no matter how much havoc they wreak, it is never enough for them. Their ethic is this: For starters, we want it all; then we want more. They represent a bottomless pit of need, and therefore, they create an endless curse of looting, chaos, destruction and death.

The House of Fraud cannot survive, because the people can no longer afford to maintain it. Already, it has financially and spiritually destroyed the American Middle Class, and this devastation spreads and becomes more acute every day.

By any officially accepted accounting measure one wishes to use, the House of Fraud has completely bankrupted the United States. Rather than admit this and reform itself, it has doubled down to loot every remaining private asset it can get its hands on before the already failing economy enters a new, more deadly phase of disintegration.

Every Royal Family needs a bank, and the Bank of the House of Fraud (BotHoF) is known as the Federal Reserve System. The BotHoF has a mono-mandate: to facilitate the maximum amount of national and global looting by The House of Fraud, without outright destroying the global economy that produces the money it steals. It views itself as an evolved, intelligent parasite: one that does not kill its hosts, at least not for as long as possible. It fully recognizes that at some point, hosts must die. By then, it expects to be “Good to Go,” with all the plunder it requires, for the then time being. The job of the BotHoF is to keep the Looting Machine in excellent mechanical condition, and the Looting Fields fertile.

The stock in trade for The House of Fraud is corruption. Corruption greases its wheels, and serves as its prime enabler. As the plundering by The House of Fraud has exponentially increased, it should come as no surprise that so has corruption.

Corruption has become so pervasive and endemic throughout the United States that it has pervaded high levels of virtually every government agency and bureau, which are now overtly politicized, scripted, subverted, co-opted and compromised.

The curse of American corruption has been growing for many years, but never more so than in the past eight. It is no coincidence that the nation’s debt has exploded at the same time, as they are direct reflections of each other.

The recent orgy of fraudulence has brought us to what we term: Peak Corruption. The United States is now at its breaking point, and can no longer afford the astronomical costs of fueling the political, banking, military, pharmaceutical, and other related engines of looting and corruption.

A deal exists between the Bank of the House of Fraud and the Washington, D.C. political establishment. The deal is this: the BotHoF will supply the politicians with however many dollars they want, as long the DC establishment agrees never to interfere with the BotHoF.

This means that the BotHoF cannot be subjected to any legitimate forms of Congressional oversight, special investigations, audits, or other types of control or review. Other than certain members of the Royal Family of the House of Fraud, no one is permitted to pull back the curtain and examine the hidden workings of the Great BotHoF. As philosophers know, secrecy has always been the workshop of the Devil.

Both parties have gladly accepted this deal. Accordingly, the BotHoF is permitted to operate in total secrecy, creating and distributing however much money it wants to whomever it wants on whatever terms it wants, and to control and divert the wealth of the nation in whatever manner it decides, in its own personal interests, without any oversight or limitation whatsoever.

This is astounding, given that the BotHoF has commandeered not its own, but rather The People’s money. Absent from every single action taken by the BotHoF are the best interests ofThe People. Which is exactly what they want. The BotHoF acts in the best interests of the Royal Family, not those of the RF’s subjects.

The BotHoF manages what has been known as the “dollar.” We believe this is an old term that no longer applies, because the current dollar bears no resemblance to what a dollar was intended and used to be. New realities require new words to describe them. Our view is that the central counterfeiters at the BotHoF now issue Dollwhores, a currency that has been recklessly pimped into epic profusion, which will result in a demographically guaranteed population explosion. The abbreviation is: Dws (Dollarwhores).

The debt of The House of Fraud fast-approaches Dws 20,000,000,000,000. (Twenty trillion.) This debt does not include the net present value of the nation’s unfunded, contingent liabilities (i.e., Medicare, Social Security, government pensions, veterans’ benefits, disability payments, subsidized health care, and so on, ad nauseum), whose burden is conservatively estimated to be between Dws 150,000,000,000,000 and Dws 225,000,000,000,000, a sum that grows by trillions of Dws every year.

These amounts are so gargantuan that they are far beyond even the capability of Ph. D.’s in economics or statistics to conceptualize, model, forecast or understand. Monetarily, fiscally and economically, we are flying blind; no one has any earthly idea about the true, ongoing dynamics of the current system or what factors could destabilize and/or destroy it, despite what they might tell you and want you to believe.

Two things are certain: 1) The debts of the House of Fraud can never, ever be re-paid in anything other than the equivalent of Reich’s Marks or Venezuelan Bolivars; and, 2) The members of the Royal Family of the House of Fraud are fully aware of this, particularly its bankers. Everything they tell you to the contrary is a deliberately concocted lie specifically designed to facilitate ongoing looting.

There is no way on this earth that any entity, including The American House of Fraud, could ever have run up existing and unfunded debts of this magnitude and then loaded them onto the backs of the citizens had a nation-destroying deal not been in place between the BotHoF, the Royal Family and the Washington DC political establishment. These insiders have enjoyed monumental windfall profits by privately cashing in on that deal.

No financier in his or her right mind would lend Dws 20 trillion to an already bankrupt entity producing nothing but massive annual, additional losses (deficits); with zero prospects whatsoever, according to its own business forecasts, of producing ten cents of surplus at any time in the future; having no turnaround business strategy whatsoever other than to spend much more money on programs already experiencing massive losses, and to launch new programs massively in deficit on their start dates, heading deeper into financial oblivion from there; and with no capability whatsoever of re-paying even one penny of its debts, ever.

Peak Corruption represents the terminal phase of any business, social system, government or collective entity of any kind. Peak Corruption is absolutely and by definition the end of the road.

Today, evidence bombards us from every direction that Peak Corruption has become a giant wrecking ball laying waste to to everything that made America great in the first place. It is destroying once trusted and trustworthy government institutions and bureaus, reducing them to reputational and dysfunctional rubble; it has structurally destroyed the productive aspects of the economy, whose capital has been looted by the Royal eleech (and no, they no longer deserve the term “elite,” which connotes positive accomplishment and distinction); it has turned politics into a frenzy of pay-for-play parasitism and greed; it has turned markets into manipulated fantasies intended to create false illusions of economic normalcy and prosperity; it has fomented wars-for-profit on an unimaginable scale, where entire nations are bombed for years on end while tens of millions of citizens become homeless, hopeless scavengers; it has financially destabilized a majority of American families, although they haven’t seen anything yet; and it has propelled so much smoke, dirt and ash into the air that it is no longer possible for the people to see their future, with any kind of clarity or reassurance.

But rising from the ashes of the destruction they have created is some good news, too: the Peak Corruption wrecking ball is indiscriminate, and is also destroying the House of Fraud, even though the HoF is using every weapon it owns, such as the Mainstream Media, to continue operations and delay its fall.

The Alternative Media has awakened tens of millions of people worldwide, and grows stronger every day. People are coming to realize that the problem is not them, but what is being done to them. And that they must act now if they are to have a future worthy of themselves.

We specialize in Inferential Analytics, a powerful forecasting method we have developed over a period of 15 years. We have never before seen so many of our measures indicating severe stress. We wrote this article to tell you that, so you can think about these issues, and take the steps you believe you need to take. If there is interest, we can provide more prescriptive information in this regard, so feel free to leave a comment if you wish.

In early November, there is a referendum on the future. If the people once again swallow the propaganda and outright lies pounded into them by the House of Fraud, then we project quickening systemic deterioration leading to extreme instability and sharply reduced opportunity. Peak Corruption simply cannot be maintained as an ongoing method of operation. If the people begin to reject the establishment agenda that is destroying them, this would be a positive development that should at least halt the expansion of the enormously destructive plague of Peak Corruption until additional actions can be taken to reverse it.

The House of Fraud has had a good run, siphoning trillions in plunder from the people during its reign. If it comes to complete ruin thanks to its own excessive, self-destructive greed plus the awakening of the people, we need not lose any sleep over the fates of its denizens. They will be just fine, though undeservedly so.

Stewart Dougherty

October 2, 2016

Stewart Dougherty is the developer of a privately-held, principles-based forecasting methodology named Inferential Analytics. The unique IA model assesses monetary, fiscal, financial, market, social, political, empirical and anecdotal factors to get a glimpse of tomorrow, today. He has 35 years of management, corporate strategy and business development experience. He is a graduate of Tufts University (MA) and Harvard Business School (MBA).

Short All Bounces In Deutsche Bank Stock – It’s Still Insolvent

Deutsche Bank has never had as safe a balance sheet in the past two decades and there is no basis for media speculations on clients leaving. – DB CEO, John Cryan in Bloomberg

So John, are you willing to make those statements under oath? The funniest report I saw today was that Deutsche Bank gave Tesla a $300 million credit line to fund Tesla’s vehicle leasing program (LINK). No wonder DB is insolvent. It’s willing to lend against collateral that spontaneously combusts. Not to mention the fact that Tesla back-end loads the terminal value of its vehicles on its leases in order the minimize monthly lease payments. Whoever approved that deal at DB is smoking strong weed.

Rumors about Justice Department multi-billion dollar fine settlements do not fix big bank insolvency. DB was insolvent before the Justice Department mortgage securities fine was conceived. Any legal fines levied by any Government will end up in line with the rest of Deutsche Bank’s creditors. Unless, of course, Grandma Merkel and her band of merry thieves agree to bailout the technically bankrupt bank. But that won’t occur until DB stock is well below $10.

We saw this same trading with Enron, Bear Stearns and Lehman when those stocks approached $10. I was short and made a lot of money on Enron and Bear – and I held my shorts through rumor-driven bounces in the stock like the one propelling DB’s stock today.

This trading activity with the stock is designed to trigger aggressive short-cover buying which enables position-dumping by the big boys who are still heavily long DB stock. The rumor that drove DB stock over $13 was tweet from a French press agency which “confirmed” that the DB was near a settlement with the Justice Department for $5.4 billion instead of the original $14 billion levied. A short-while later the French press agency back-pedaled on the assertion.

The more relevant information to consider is the signal being flashed in the market for DB’s credit default swaps. The cost of insure DB’s junior bonds for one year surged to 625 basis points today. This inverted the “curve” for the cost to insure DB’s bonds, as the cost to insure the bonds for five years was 505 basis points. The same is true for one yr. vs. five yr. swaps on DB’s senior debt, which were trading at 270 basis points vs 241 basis points respectively: DB Stress Signal Reemerges – Bloomberg

A credit default swap the costs over 600 basis points to purchase is analogous to a triple-C rated U.S. corporate bond. Company’s with the “triple-hook” credit rating in the current insane financial system are semi-dead corpses with electric stimulation paddles being applied in an attempt restart the heart. These are bonds that have a greater than 70% chance of eventually defaulting. In other words, investors who are willing to pay over 600 basis points for one year of default protection on their DB junior bond position believe that the risk of DB defaulting in the next 12 months is exceptionally high.

If the German Government was not lurking in the background, these credit default swaps would be priced at well over 1000 basis points over the equivalent Treasury yield. On the other hand, DB CEO, John Cryan, stated on Friday that DB’s balance sheet is safer than at any point in the past two decades. That at least the third time DB liquidity rumors have been denied and we know what that means…

I don’t know if this reminds more of Jim Cramer pounding the table on Bear Stearns stock at $62 shortly before it plunged to $2 or Lehman CEO, Richard Fuld, proclaiming that Lehman had billions on highly liquid assets about 5 weeks of ahead of the stock plunging to near-zero (graphic from Zerohedge):